Banking Solution

Empower your success in the digital era with the essential tools provided by our Banking Solution.

Revolutionize your banking experience with our cutting-edge banking solutions designed to propel financial institutions into the future. Our advanced technology seamlessly integrates with your operations, offering real-time insights, enhanced security, and unparalleled user experiences. Stay ahead of the curve and elevate your financial services with our innovative solutions tailored for the modern banking landscape.

Contact With Us

+88 01713 -044055

Banking Solutions We Provide

Letter of Credit(LC) process automation

Automating the Letters of Credit (LC) process in banking enhances international trade efficiency by reducing errors, accelerating processing times, and improving risk management.

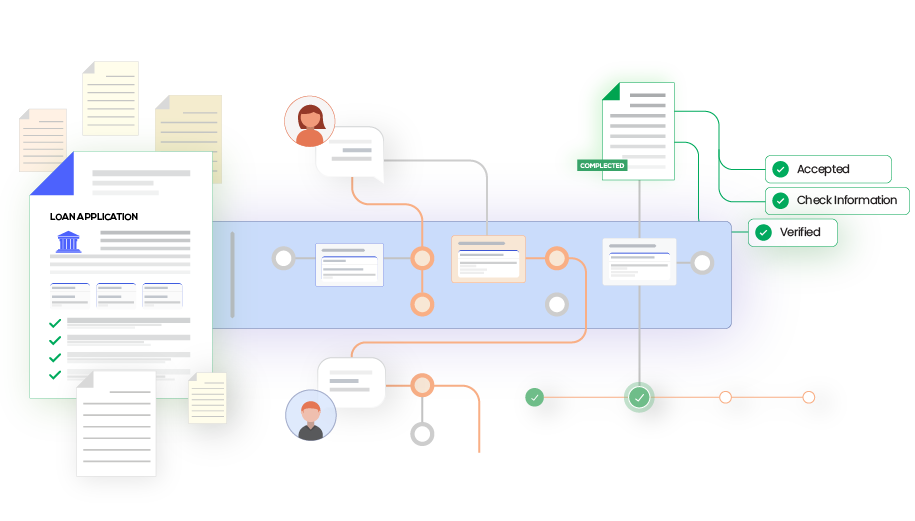

loan/investment Document process

Automating the loan/investment document process in banking brings efficiency and reduces errors. Key steps include digitizing documents, implementing electronic data interchange, workflow automation

account opening process

Automating the account opening process in banking streamlines operations and enhances customer experience. This involves digitizing documentation, implementing electronic forms, integrating with identity verification systems.

application process

Automating the application process in various domains, such as job applications or service requests, improves efficiency and user experience. This involves implementing electronic forms, integrating with databases.

application process Automation

Automating the application process in banking brings efficiency and reduces errors. Key steps include digitizing documents, implementing electronic data interchange, workflow automation

recruitment process

Recruitment process automation not only saves time and resources but also improves the overall quality of hiring by reducing manual errors and biases. It allows HR teams to focus on strategic aspects of talent acquisition

Benefits Of Banking Solution

Banking Solution Services are indispensable for financial institutions aiming to provide customers with secure, convenient, and personalized banking experiences while maintaining compliance, managing risk, and optimizing operational efficiency.

- Improved Efficiency

- Enhanced Customer Service

- Enhanced Security

- Collaboration And Sharing

- Faster Time-to-Market

- Focus on Strategy

- Flexibility and Adaptability

- Scalability

- Adaptability

- Quality and Accuracy

Focus on Core Competencies

BPO allows businesses to concentrate on core activities.

Expertise Access

clients gain access to specialized skills and industry knowledge.

Our Clients

Our clients empowered up to provide world class services and products. Thanks to them.